Uncategorized

What does the Coronavirus mean for your student loans?

President Trump signed a bill providing financial relief for Americans struggling in the wake of the coronavirus shutting down all non-essential businesses. Part of that bill granted a six-month suspension period on federal student loan payments until September 30th. However, not all federal loans are included in the bill and loan providers are not adapting…

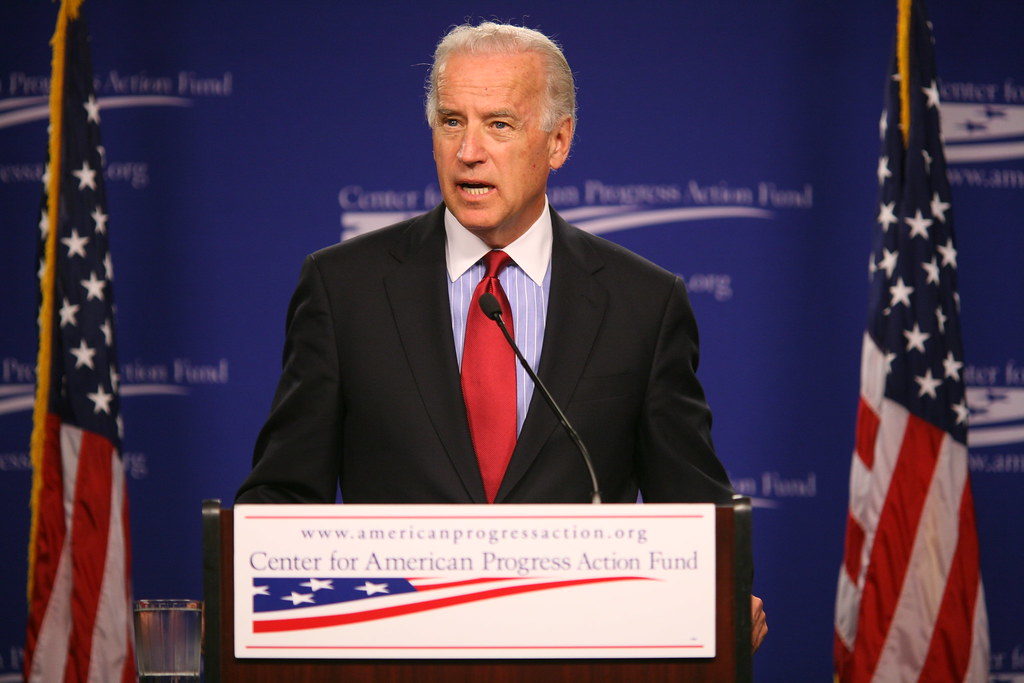

Read MoreBiden Legislation Stripped Borrowers of Their Bankruptcy Protections

Before Biden and Warren were at odds for the Democratic Presidential nomination, they faced off against bankruptcy protection laws, with Biden successfully stripping them away right before the 2008 housing crisis. In 2005, Biden pushed through a bill called the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) intended to prevent people from abusing a…

Read MoreIs the Coal Industry Slipping into Obsoletion?

On Friday, Oct 11, CNN Business reported that Murray Energy owned by Robert Murray, the “king of coal”, is slipping into “financial collapse”, thus marking another coal business plummeting into bankruptcy. For coal miners and those in the coal industry, this means that the industry will likely become obsolete within the next few years among…

Read MoreJudge Drain Rules in Decision Best for Opioid Survivors in Purdue Pharmacy Bankruptcy

Last Friday, October 11, White Plains Bankruptcy Judge Robert D. Drain paused legal action between 25 states suing Purdue Pharmacy. The New York Times reported that Judge Drain made this decision to prevent mounting litigation costs that would take away from the settlement to opioid survivors and other parties in the Chapter 11 bankruptcy settlement. …

Read MoreDepartment of Education being sued by Teachers

First states and now teachers are suing the Department of Education for the faulty program intended to help student loan borrowers: the public service loan forgiveness program. Previously last summer, four states including California, Pennsylvania, Washington, and Illinois sued the government agency Navient for its mismanagement of private and federal student loan debt, especially for…

Read MoreWill the New Year start with a recession?

Several states across America, especially in the southern states like Tennessee, Alabama, and Georgia, are experiencing an increase in bankruptcy filings according to NerdWallet. Market Watch, The New York Post, and CNBC have all published articles speculating on the rise of bankruptcy filings as a symptom of an impending recession. Market Watch in their article…

Read MoreDOE no longer giving full discharge for defrauded cases

The U.S. Department of Education is passing an act that will make it harder for students to sue for-profit colleges for claims of fraud or misleading practices. As of July 1, 2019, this act would evaluate the students’ need for compensation based on their salary compared to their peers, instead of receiving a full discharge…

Read MoreFour States Suing Navient, Government Agency In Bed With DOE

California is the fourth state to file a lawsuit against one of the government’s largest debt collecting agencies: Navient. California is the largest state to file a lawsuit against Navient, joining Pennsylvania, Washington, and Illinois. Navient is one of the eight largest debt collection services hired by the United States “to collect $1.4 trillion owed…

Read MoreDepartment of Education Not Allowing Loan Forgiveness

Four senators are taking a stand against Betsy DeVos and the dysfunctional Department of Education when it comes to student loan forgiveness. Federal loans make up $1,331.7 billion of all student loan debt as of this year . Democratic Senators Tim Kaine, Sheldon Whitehouse, Tammy Duckworth, and Maggie Hassan sent a letter to Secretary DeVos…

Read MoreWells Fargo in trouble?

Wells Fargo Bank has been faced with penalties due to ignoring student loan debt in debtor Ryan’s bankruptcy. Ryan filed for bankruptcy in 2007 and after his discharge; Wells Fargo commenced litigation and collection actively on the debt. In 2008, Ryan was making monthly payments of $150 on the loan that would be made for…

Read MoreIvy League Debt free?

Brown University is a private Ivy league university in Providence, Rhode Island, that is known for its unique teaching, curriculum, and research. This prestigious university is ranked #14 in national universities. Its tuition and fees is about $53,400 and about 43% of students are receiving financial aid. Brown offers $112.5 million. With that said, Brown…

Read MoreTrump Tax Reform and Student loans

Within the United States, according to IRS records, there are forty-four million Americans with student loan debt. President Trump’s tax reform bill states that “special interest deductions” will be made in the areas of medical expenses, adoption and student loan interest rates. The Trump administrations alleged overall goal of the tax cut is to grow…

Read MoreEmployees get financial help from Employers for their student loans?

According to Pew Research Center: Social and Demographic Trends, 53% of employers are likely to stay at their current job with SLP, 64% of employees are likely to recommend their company to a friend for employment opportunity, and 74% of employees report being happy at their place of employment with SLP(2016). Since this launch, many…

Read MoreSecret Service…Broke?

Has the Secret Service Gone broke trying to protect Trump? Over 1000 agents have already exceeded the mandated cap for overtime. This was supposed to last them a year. A total of 42 people are being protected and 18 of them are members of his family. However, during Obama’s administration, there was only 31. This…

Read MoreTuition Free New York City Colleges

Hillary Clinton and Governor Andrew Cuomo signed into effect a law that provides free tuition to public colleges and universities in New York State. The requirements and stipulations makes me question whether “free” college tuition has seen achieved or if it remains out of reach. Any progress towards this goal is appreciated, but upon reading…

Read More