Posts by Michelle Labayen

Senator Warren Pushing For Bankruptcy Discharge

Congress is paying attention to student loan debt though—and bankruptcy is increasingly part of the debate. There was a a hearing this morning in the Senate Banking Committee on student loans, where Senator Elizabeth Warren pushed very strongly in favor of allowing bankruptcy discharge. You can watch the full hearing at this link (Sen. Warren’s…

Read MoreWhat You Should Know About Predatory Payday Loans

Most people who have encountered economic hardships look for solutions to get a little bit of money to hold them over until pay day. For some, a solution is to get a “payday loan”. A pay day loan is a relatively small amount of money lent at a high rate of interest on the agreement…

Read MoreAG Settlement One Year Later

The attorney generals sued the five largest national banks and reached a 25 billion dollar settlement in regards to mortgage fraud. For all of the outrage and obvious wrong doing, where are we today? 10 billion was to “quickly” be delivered to hundreds of thousands of people. 732,000 settlement checks have not been delivered 600…

Read MoreEminent Domain And The Aftermath of Hurricane Sandy

Eminent Domain is back in the media and being used by Governor Christie. In a nutshell, eminent domain is a rarely used legal premise which allows the government to take private land for the public good. A typical scenario is if a city takes a deserted, dilapidated area and transforms the area into a park.…

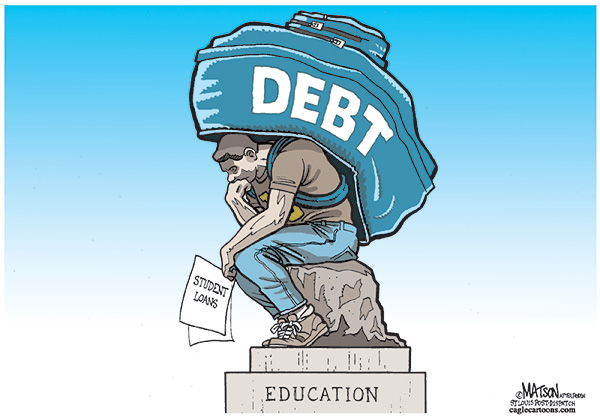

Read MoreStudent Loan Debt Crisis And The Role Of The Bankruptcy Court

Trillions of dollars in student debt is held by Sallie Mae. Student loan debt is preventing the 20-30’s year olds from entering the so called “middle class”. Today, politicians are discussing a remedy by allowing student loans to be discharged through the bankruptcy court without the strict adherence to In Re Brenner (undue hardship). The…

Read MoreWhat Happens After You Surrender Your House In Bankruptcy

You have finally come to the decision that you are willing to surrender your house. This decision did not come easily. You probably spent years dreaming about your house, years paying for your house, possibly years going through a failed loan modification process and finally decided to file bankruptcy. If you decided to surrender your…

Read MoreFast Track Modifications Are Back

Déjà vous? Fast track modifications are back with multiple banks and service providers. Before the melt down in 2008, loan modifications were provided over the phone with little or no documentation. The homeowner would call the bank, answer a few questions and would be provided a modification over the phone. The theory behind this ease…

Read MoreDetroit vs Everybody

Detroit filed bankruptcy, what does this mean? Detroit has chosen to file a Chapter 9 bankruptcy in order to eliminate, reduce and/or renegotiate its debt with creditors. Although many still hear bankruptcy and become frightened, it is better for Detroit to consolidate the lawsuits, creditors and attorneys all in one room, courthouse, then multiple courthouses,…

Read MoreChapter 7 Vs Chapter 13

A lot of people are familiar with a Chapter 7 and usually go to an attorney requesting their Chapter of preference. Many people prefer a Chapter 7 because it is quick and relatively simple. All of the unsecured debt is discharged in approximately 90 days. You can also surrender your interest in secured property like…

Read MoreThe LOAN Ranger

Back in July I blogged about the idea that the State of California considered….Eminent Domain. The idea of Eminent Domain is that the government can take land that is not being used to its potential and reuse it for the good of the state. California argued that if they could take the massive load of…

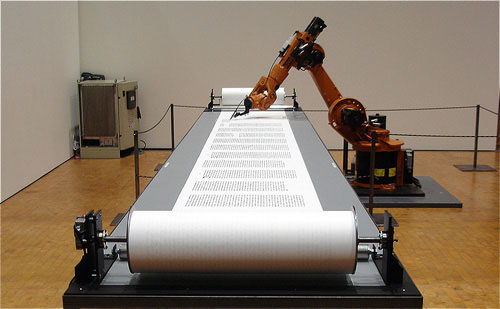

Read MoreNotes, Assignments and Certification

A lot of people may be familiar with” Robo signing”( someone without authority rubber stamping assignments) which created a moratorium on foreclosures throughout the country, but particularly in New York and New Jersey. New York judges created new rules for attorney certifying the documents that they provided to the court to be true and exact…

Read MoreDummies Guide to REMIC, Trusts and your Mortgage

First of all let me start by saying that REMIC Laws and Trusts, which are the bases of securitized investment property, is very complicated and convoluted. Experts in securitization and REMIC laws have difficulty sorting through the maze that the banks have created. However, I am going to attempt to reduce it to very basic…

Read MoreOverturned AGARD

A year or so ago, a lot of us consumer/bankruptcy attorneys were ecstatic about Judge Grossman’s decision about MERS and its assignment of mortgages. Judge Grossman could not rule on the case before him if MERS had the authority to assign the mortgage based Res Judicata and Rooker-Feldman doctrine, (Decided cases in state law cannot…

Read MoreHow much will Fannie Mae pay to fire their Servicers?

As many know, Fannie Mae is a complete and utter failure. The creators of Fannie Mae, Freddie Mac and Ginnie Mae, may have had the best intentions, but we all know the saying about having the best intentions. Simply put Fannie Mae was set up to help income based families receive loans to by homes.…

Read MoreUS Attorney General Prett Bharara files complaint against Wells Fargo

Many people have received notices to join in a class action against their mortgage company or servicers. A class action is basically a combination of multiple plaintiffs (in this example homeowners) from multiple states with the same complaint ( in this case fraud, misrepresentation) against the same defendant ( in this example your bank or…

Read More